drawdown forex meaning

So if you have one trade open that is currently negative 40 pips for a total of -4000 USD that is a drawdown of 4000 total. There are several factors that increase your drawdown risk and the downside volatility in a traders account.

Forex Forex Statement Forex Money Trading Forex Brokers

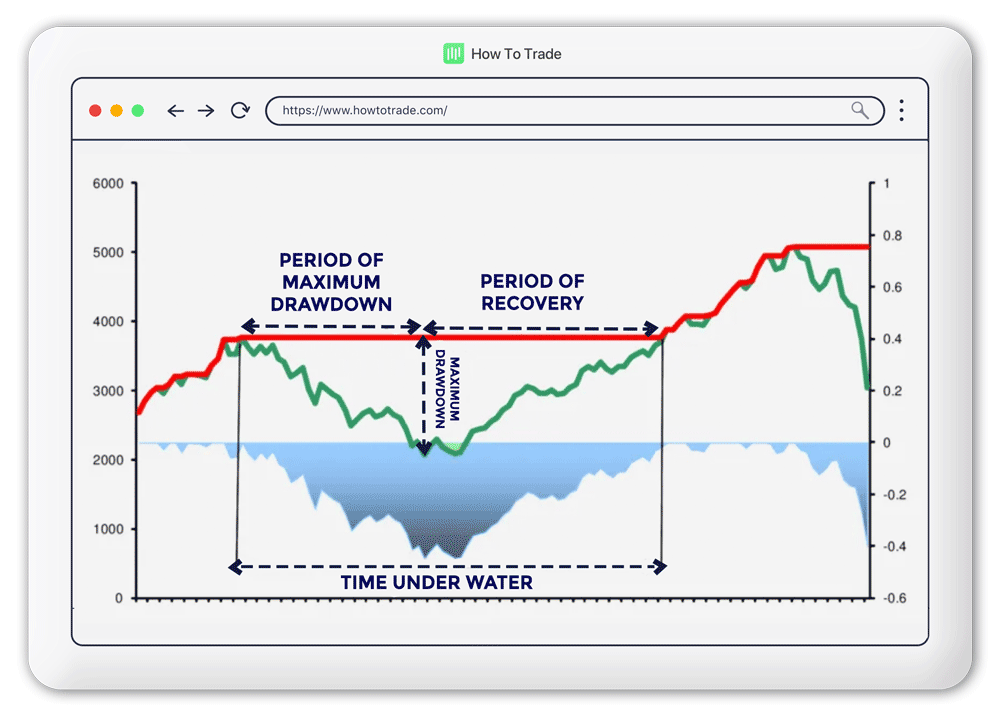

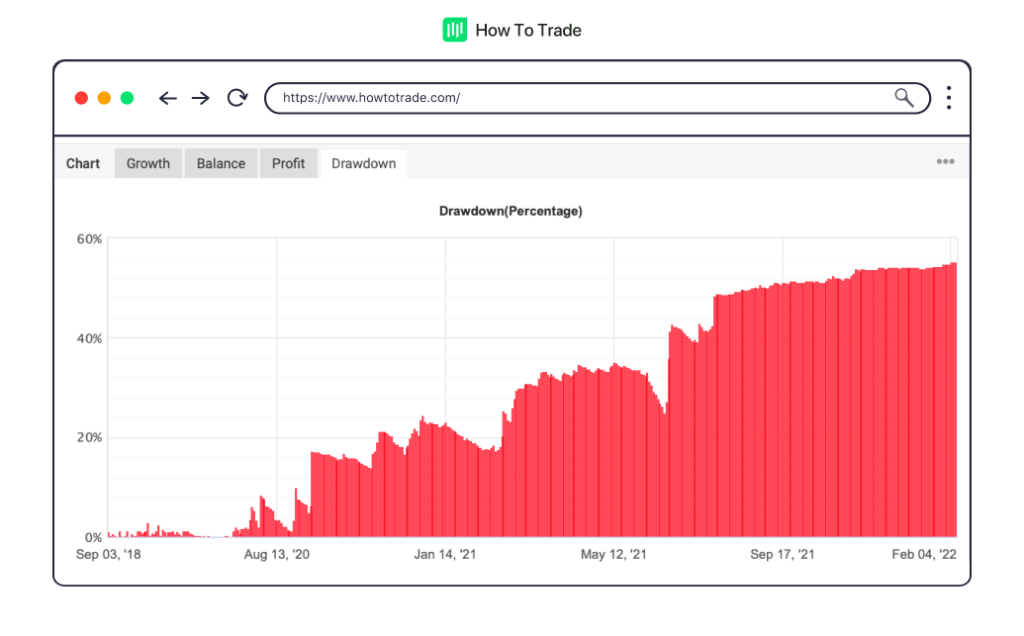

A lot of old paradigm traders and even new traders like to see historic drawdowns over the course of a long time.

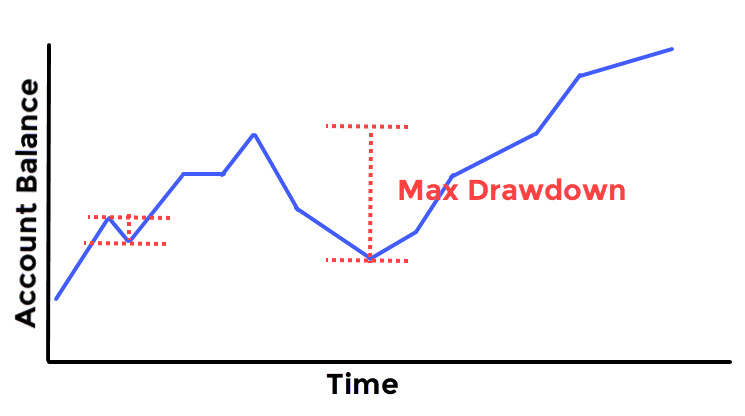

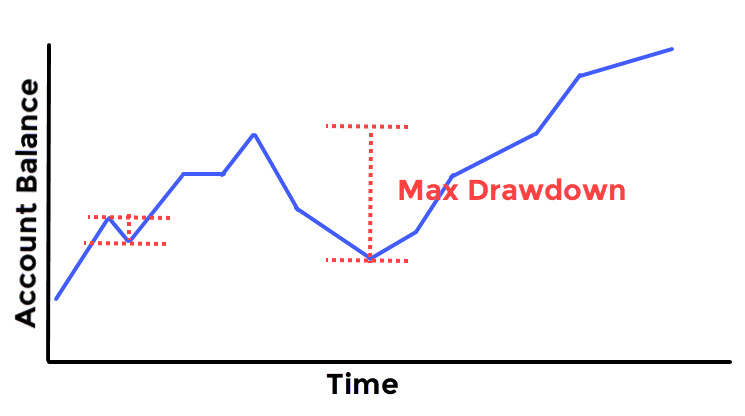

. A drawdown is the reduction of ones capital after a series of losing trades. Drawdown Meaning in Trading. A drawdown is a peak-to-trough decline during a specific period for an investment trading account or fund.

For example you had a balance of 10000 but after a bad trade your trading account balance after that trade is 9500. A trader can open a position in one moment make a 2 drawdown and then close position 3 in profit. A drawdown is defined as the percentage of decline in the value of a security over a period before it bounces back to the original value or beyond.

The term drawdown in forex trading refers to the difference between a high point in the balance of the trading account and the next low point of your trading accounts balance. The Biggest Causes of Drawdowns in Forex Trading. This is what traders call a drawdown.

Drawdown definition in forex refers to reducing equity how much an investment or trading account is down from the peak before it recovers to the height. In a simple explanation a forex drawdown is the largest amount you lose when trading currency pairs before you start making a profit again in your trading portfolio. This is not the very first item that provided this kind of help and service.

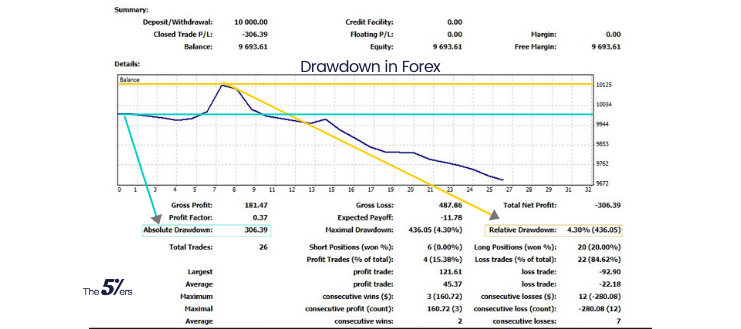

Drawdown is a measure of peak-to-trough decline that is usually expressed as a percentage. When your equity is losing more than your balance it is referred to as a drawdown. No matter what trading strategies you use for forex a drawdown is bound to happen sooner or later.

Traders normally note this down as a percentage of their trading account. In forex trading drawdown DD refers to how much money you have lost in your account balance or from a particular trade. A drawdown is usually quoted as the percentage between the peak and the subsequent.

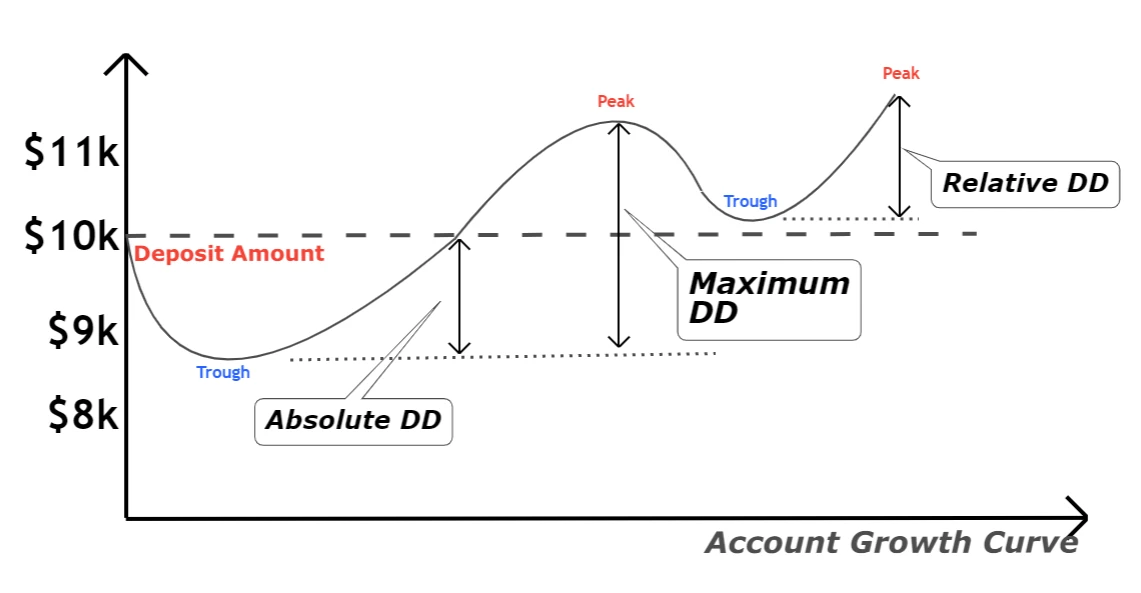

A maximum drawdown of a trade refers to the most amount of drawdown observed in your account until there is a new peak. In forex specifically drawdown refers to a reduction of equity in your portfolio. Drawdown is a key measurement in your trading because if you let it get out of hand you can quickly put a large hole in your account.

In Forex trading drawdown is the difference between your initial account balance or equity peak and your equity trough. Drawdown in your Forex trading is the amount your account loses from its peak. A forex trader experiences a drawdown when losing equity on their account in a trading period.

What is drawdown in forex. It is the amount that has been drawn from your account after losses in forex trading. What makes this stick out is the truth that it is automated.

You will choose peaks and troughs depending on the timeframe you wish to calculate drawdown for. What is important to analyse though is how much those losses reduce the capital. In this article I will be discussing what drawdown is how to calculate drawdowns and how to handle drawdowns in forex trading.

If you had an account balance of 50000 but you now only have 25000 then you suffered a drawdown of 25000. What is Drawdown in Forex Trading. A drawdown is when a forex trader loses equity in their account in a trading session.

This is normally calculated by getting the difference between a relative peak in capital minus a relative trough. The drawdown in forex is the capital reduction that a trader has after a series of losses. Thats the definition of drawdown in Forex trading.

What does maximum drawdown mean. The term drawdown in forex trading refers to the difference between a high point in the balance of the trading account and the next low point of your trading accounts balance. It refers to the difference between the peak or high point in your trading account balance and the next trough or.

But after trading for few days now your account balance is 9000. For example you had a balance of 10000 but after a bad trade your trading account balance after that trade is 9500. When the equity balance drops below the account balance ie.

Drawdown in trading refers to the reduction in your trading account as a result of a trade or series of trades. Therefore the drawdown of this trade is a much smaller 1125 as compared to the first scenario. Calculating the drawdown value helps.

What is drawdown in forex. It refers to the lost capital because of the losing trades. Whenever your overall capital is reduced in the forex market you are experiencing a drawdown.

It is the amount that has been drawn. A drawdown DD in forex trading refers to the percentage of the money you have lost from your trading account balance when making a particular trade. It refers to the lost capital because of the losing trades.

Knowing how to control it will help you have a successful trading career. There are a great deal of people who question this item. It is expressed as the difference between the highest ie the peak value of that asset and the lowest ie the trough value of the same.

You dont have to use the highest peak and deepest trough either. A drawdown refers to a percentage decline in the value of a trading account between the highest peak of the account to the lowest point it is the lowest point of the account which is the drawdown. Drawdown 2250 20000 x 100 1125.

In other words the difference between a peak in the account balance and a low point in the account balance is defined as a drawdown. Drawdown and loss are not the same things. Drawdown in forex is the difference between the account balance and the equity or is referred to as the peak to trough difference in equity.

For example the total balance in your MT4 account is 10000. Every trader during their trading activity will experience losses as well as winnings. So what is drawdown.

Drawdown is the balance difference in your account from live trades. In trading the drawdown refers to the peak-to-trough decrease during a particular period for your trading account. Things to Know About the Forex Drawdown Meaning.

As one might know the equity balance changes based on the open positions PL. In the foreign exchange trading market its the difference between the high point in the traders account balance and the subsequent low point of their account balance. Drawdown in forex refers to the percentage of the amount of losing trades in a row.

Python Ea Forex Python Robot Programming

What Is A Drawdown In Forex And How Do You Control It

Pin By Deniz Torn On Software For Forex Payoff Scalper Forex

Drawdown Forex Meaning And Explanation Forex Forex Strategy Meant To Be

458 Me Gusta 8 Comentarios Illyrian Forex Illyrian Forex Al En Instagram High Impact News Events Trading Charts Gross Domestic Product Day Trader

Drawdown In Forex How Does It Make You A Better Trader

What Is A Drawdown In Forex And How Do You Control It

Effective Money Management Ea Free Edition Day Trading Forex Trading Strategies Option Trading

4 Simple Ways On How To Get Out Of A Forex Drawdown

What Does The Term Drawdown Mean In Terms Of Forex Trading Quora

Fibonacci Ea Fibonacci Money Management Advisor

Sniper Suite Ea Review Sniper Reviews Advisor

How To Keep Drawdown In Forex Under Control Daily Price Action

Three Types Of Drawdown In Forex Forexbee

Drawdown And Maximum Drawdown In Forex Howtotrade Com

What Is Drawdown In Forex Forexboat Trading Academy

Automated Forex Trading On Autopilot Automated Forex Trading Forex Forex Trading